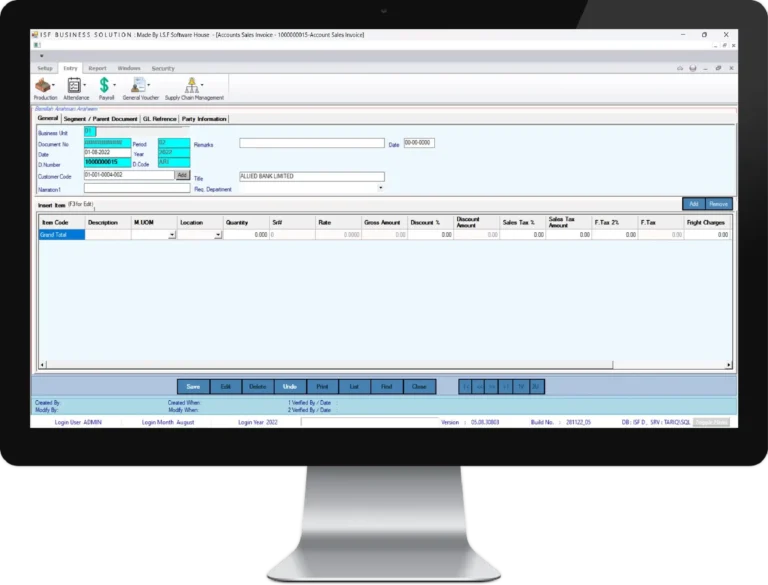

Automation of Accounts Receivable

Increase working capital with the only unified platform for cash collection, credit provision, and cash flow analysis. It’s time to upgrade your accounts receivable via accounts receivable automation software.

Transform your accounts receivable operations with sophisticated AR automation that adds value throughout your organization.

Accounts receivable, order to cash, and credit management are all examples of credit management. Whatever your company’s process or department is named, collecting cash, giving credit, analyzing cash flow, and maximizing working capital are all crucial to its success.

By eliminating manual, error-prone procedures and delivering essential decision intelligence, Backline’s unified accounts receivable automation solution improve organizational performance and capacity.

Request a Free Consultation

Accounts Receivable Automation Must Be Improved

Use intelligent automated accounts receivable to free up cash from customers and maximize working capital by generating world-class order-to-cash operations.

Accounts receivable automation should be used instead of human AR operations

Manually creating, emailing, or uploading invoices to customer portals is inefficient and risky. Automate these operations to give your accounts receivable team more time to focus on higher-value tasks. Finance and accounting professionals in a variety of industries benefit from our accounts receivable automation software because it streamlines the process and essentially eliminates the possibility of costly human errors.

Management of Credit and Risk

Profitability is dependent on effectively balancing income and the risk of nonpayment.

Create and implement risk policies that include dynamic reporting and alerts that identify at-risk consumers and ensure real-time risk profiling. To keep on top of client behavior trends, provide real-time analysis with more insight.

Collections Administration

Releasing cash from customers is the most cost-effective strategy to boost working capital.

Learn which collection techniques work throughout the client base, using automated accounts receivable, and escalating recovery sequences to approach consumers at the correct time and in the way they like to be reached. This frees up your team’s time to focus on taking actions and developing customer connections that lead to greater business outcomes.

Deductions and Disputes Management

Resolve customer issues as soon as possible in order to recover debt and maximize working capital.

Using automated procedures, you may speed up dispute resolution while maintaining client connections. This allows for complete control and visibility of disputes, as well as enhanced insight into how they affect key performance indicators (KPIs) such as DSO and old debt provisions.

Task and Team Management

Focus on data-driven goals to maximize and optimize your team’s time.

Automated accounts receivable professionals may improve decision-making using decision intelligence and take actions that produce better business results with access to data that is often difficult to get.

Intelligence in automated accounts receivable

Transforming data into knowledge necessitates real-time insight rather than out-of-date information.

Automatically process, analyses, and expose essential information such as sales and payment performance statistics, customer payment patterns, and day’s sales outstanding (DSO) to enable business stakeholders to better manage risk exposure and build operational performance goals.

Advantages of AR Automation

The most significant impediment to accounts receivable efficiency is because automated accounts receivable procedures are frequently overly complex: too many distinct financial systems, too little standardization, and too many human stages – sometimes aggravated by delays caused by difficulties that require immediate resolution. ISF’s automated accounts receivable software overcomes those difficulties swiftly, correctly, and with assured results by automating the process from start to finish.

Cut expenses

Because time is money, eliminating time-consuming manual automated accounts receivable in Pakistan procedures results in immediate savings. Accounts receivable software for business automates time-consuming and costly operations like as credit evaluation, manual print and post, manual PDF-over-email invoicing, payments reconciliation, dispute resolution, and collections. Using automated accounts receivable enhances the efficacy and efficiency of automated accounts receivable and IT workers, boosts production, and removes the costs associated with paper invoicing.

Increase Efficiency

Accounts receivable invoice automation significantly decreases the time it takes to process paperwork and payments, allowing automated accounts receivable software employees to focus on other tasks. Reduce client enrollment time from weeks to days by eliminating the time wasted e-mailing and uploading papers to customer invoicing portals. Automating your invoice distribution to adhere to delivery timetables and apply extremely specific sending criteria improves productivity and hence the bottom line of your business.

Improve Precision

AR automation increases data consistency and real-time responsiveness while managing many clients and complicated systems by removing human error from the loop. ISF’s automated accounts receivable software enables tighter internal controls, increases quality, greatly minimizes or eliminates mistakes such as duplicate payments, overpayments, and fraudulent payments, and makes early payment discounts easier to record. ISF’s automated accounts receivable system helps your company to cut expenses, improve cash flow, and reduce risk.

Increase Working Capital

Accounts receivable automation systems from ISF’s accounting Software in Pakistan for business provide assured and set DSO on all receivables, reducing DSO by days and eliminating delinquent. You can avoid late payments owing to disagreements and reduce bad debt by eliminating manual operations.

The ultimate solution to your Accounts Payable challenges

ISF keeps track of all payments and expenses so you always pay on time and never go over your limit.

Streamline the flow of purchase papers.

Everything from requisition to invoicing administration may be automated. Track and collaborate on the same documents from any device while tracking all purchase activity across numerous projects.

- Purchase Order a bill... Everything synchronized in real time

- Tracking discrepancies

- Tolerance rates for supplier invoices

- Exceptions that may be customized and extra workflows.

- Order modification

Approve 2.5 times faster

Never postpone a purchase or lose a supplier discount because of a delayed approval. Using any circumstance, automatically route papers to the appropriate decision-maker.

- Location, department, project, and custom field approvals

- Ability to amend, reject, and re-approve POs

- History of revisions for a compliance audit

- Policies and thresholds for exact routing

- Mobile approvals on the go

Gain complete cash flow transparency.

In just a few clicks, you can prevent corporate spending pandemonium, boost expenditure visibility, and streamline the reimbursement process.

- Management of Expense Reimbursement (e.g., work trips and events)

- Controlling corporate credit card payments

- Simple reconciliation of bank statements and payments

- There are three currencies available: item currency, document currency, and corporate currency.

- Taxes, legal entities, and interaction with accounting systems are all included.

Never go overboard with your spending.

Stay cost-effective and spend your money wisely. Report to stakeholders without the hassle of mismatched documents or broken audit trails.

- Real-time budget tracking with a dashboard that includes progress bars and pie charts

- Project, location, department, custom fields, and custom periods budgeting

- Setting budget constraints, calculating total, available, reserved, and spent funds

- Budget analytics that are insightful and used in financial reporting, audits, and planning

- Budget import and management in bulk